tax avoidance vs tax evasion hmrc

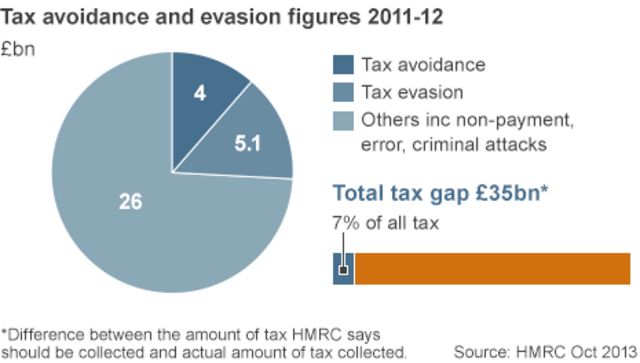

The tax evasion vs tax avoidance debate is a long-standing one. According to Hyde 2010 tax evasion cost the UK treasury over 15 billion annually.

Tax Avoidance Vs Tax Evasion What S The Difference Informi

It always creates a lot of anger and questions about how to get away with.

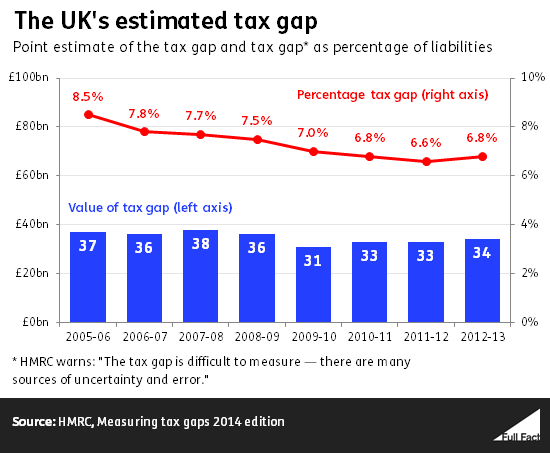

. These statements are likely to be misleading. HMRC does not approve any tax avoidance schemes. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities.

In fact it was announced in the Spring. Tax planning either reduces it or does not increase your tax. It is estimated that in 201920.

A tax avoidance scheme is an artificial arrangement to avoid paying the tax. Tax avoidance has always created interesting news. This is much easier to define as to have.

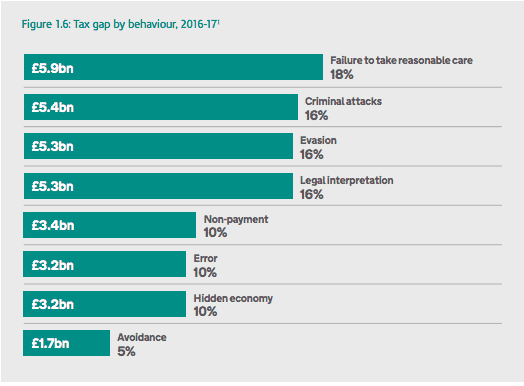

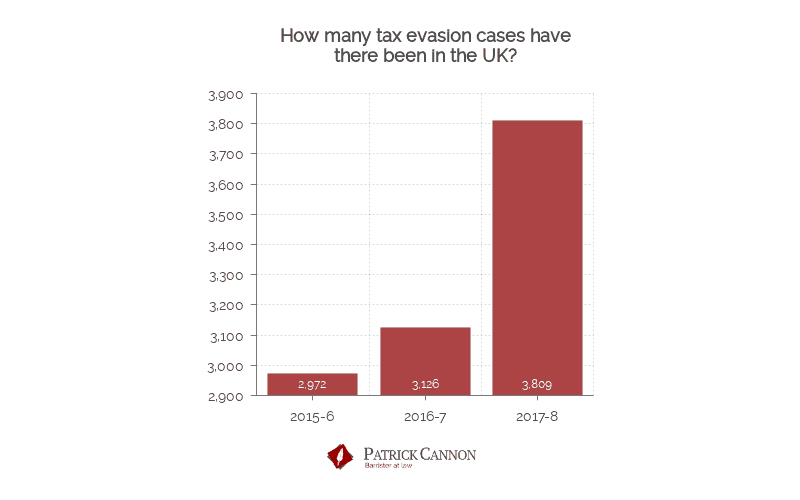

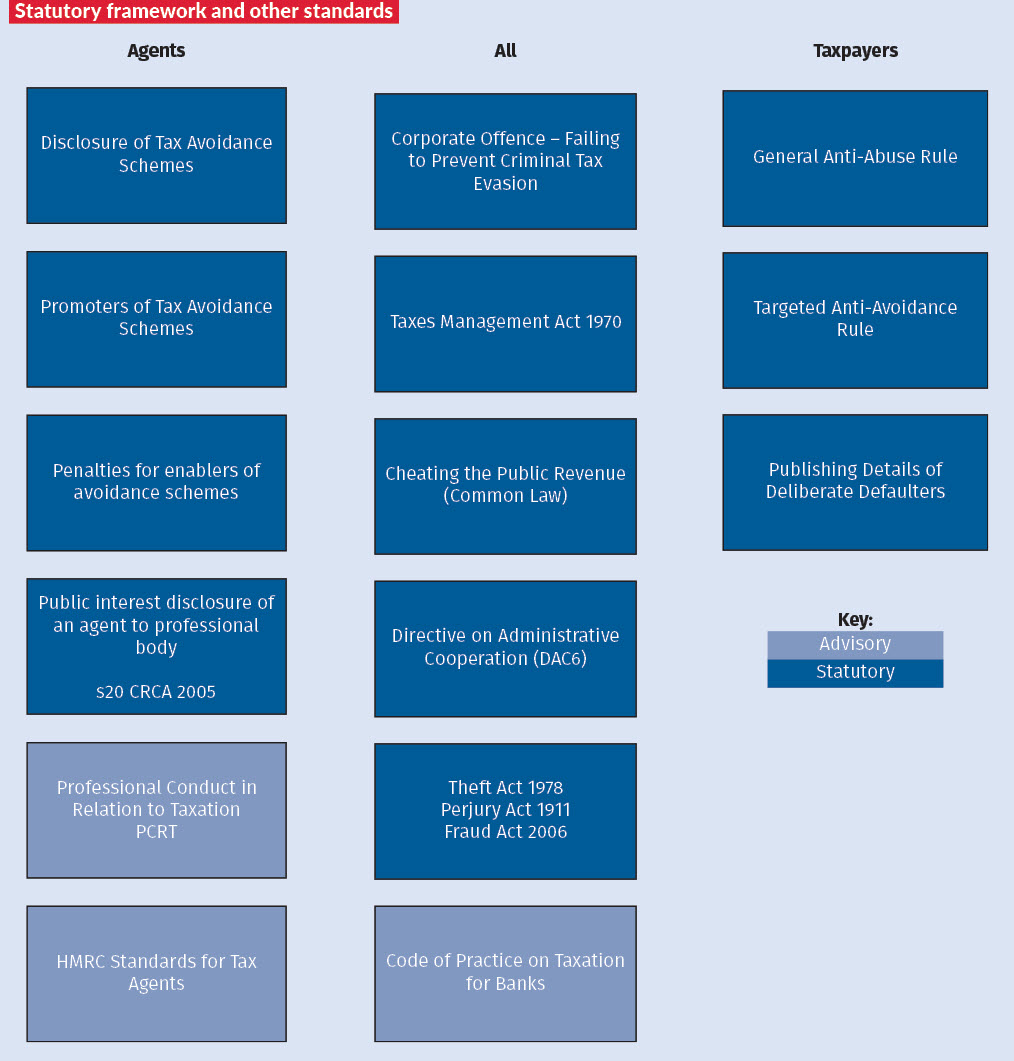

Unsurprisingly this is an area where HMRC are making great strides with many new measures being introduced to help crackdown on tax evasion. On 16 Feb 2022. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax.

It even makes big news for celebrities and large multinationals. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Tax Evasion Wiki Thereaderwiki If HMRC has identified an arrangement as having the hallmarks of tax avoidance and are investigating it you will receive an SRN by your.

What tax avoidance is. Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down. Avoiding tax is legal but it is easy for the former to become the latter.

HMRC does not approve tax avoidance schemes. HMRC define a tax avoidance. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two.

For example getting taxable income as loans or other payments youre not expected to pay back. HMRC has given it a scheme reference number SRN. This is approximately 3 of the total tax liabilities that individuals and.

The topic of tax evasion vs tax avoidance is popular amongst both tax payers and accountants but what is the difference between the two. Schemes HMRC has concerns about You can find examples of tax avoidance schemes HMRC is looking at closely. The difference between tax avoidance and tax evasion essentially comes down to legality.

Tax evasion and avoidance schemes are designed to reduce peoples tax bills and are both viewed negatively by HMRC. The difference between tax avoidance and tax evasion is.

Hmrc S Official View On Avoidance Evasion And Tax Planning Nucleusfinancial Com

How Does Hmrc Expose Tax Evasion And Avoidance

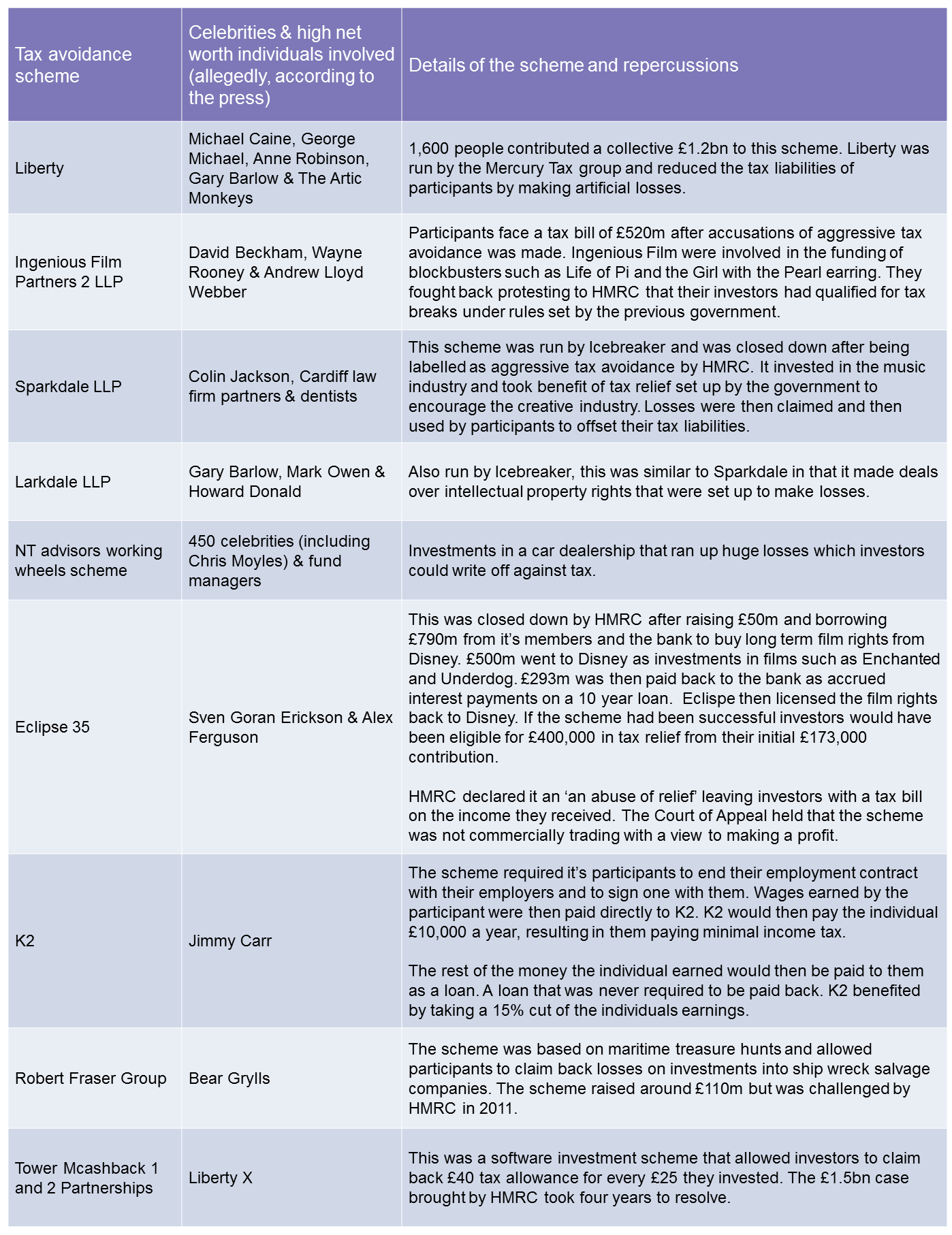

9 Exposed Celebrity Invested Tax Avoidance Schemes

Tax Avoidance Vs Tax Evasion What S The Difference

Calls To The Hmrc Tax Avoidance Hotline Have Gone Up

Which One Would You Focus On The Tax Gap Or Benefit Fraud

Hmrc S Tax Gap Data Implies They Are More Than 100 Efficient In Beating Big Business Avoidance Each Year And That S Just Not Credible

Tax Evasion Vs Tax Avoidance The Difference Aston Shaw

2019 Uk Tax Avoidance Statistics Tax Avoidance Schemes

Hmrc Tax Avoidance And Evasion International Adviser

Tax Dodging And Benefit Grabbing The Scale Of The Problems Full Fact

Hmrc Ups Pressure On Agency Staffing Due Diligence Accountingweb

Uk Tax Evasion Crackdown Expected To Net 2 2bn Financial Times

Hmrc Ramping Up Pressure On Tax Evaders Ftadviser Com

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Tax Evasion And Avoidance How Much Can Be Raised Full Fact

Changing Tax Avoidance Attitudes Hmrc Research Tax Evasion

Measures Available To Hmrc To Tackle Avoidance And Evasion Taxation